Introduction

Cryptocurrency markets operate 24 hours a day, seven days a week, across global exchanges. Unlike traditional equity markets with fixed sessions, crypto trading is continuous, volatile, and often influenced by rapid shifts in liquidity and sentiment. In such an environment, traders frequently focus on indicators, news, and price momentum while overlooking one essential element of performance improvement: structured trade review.

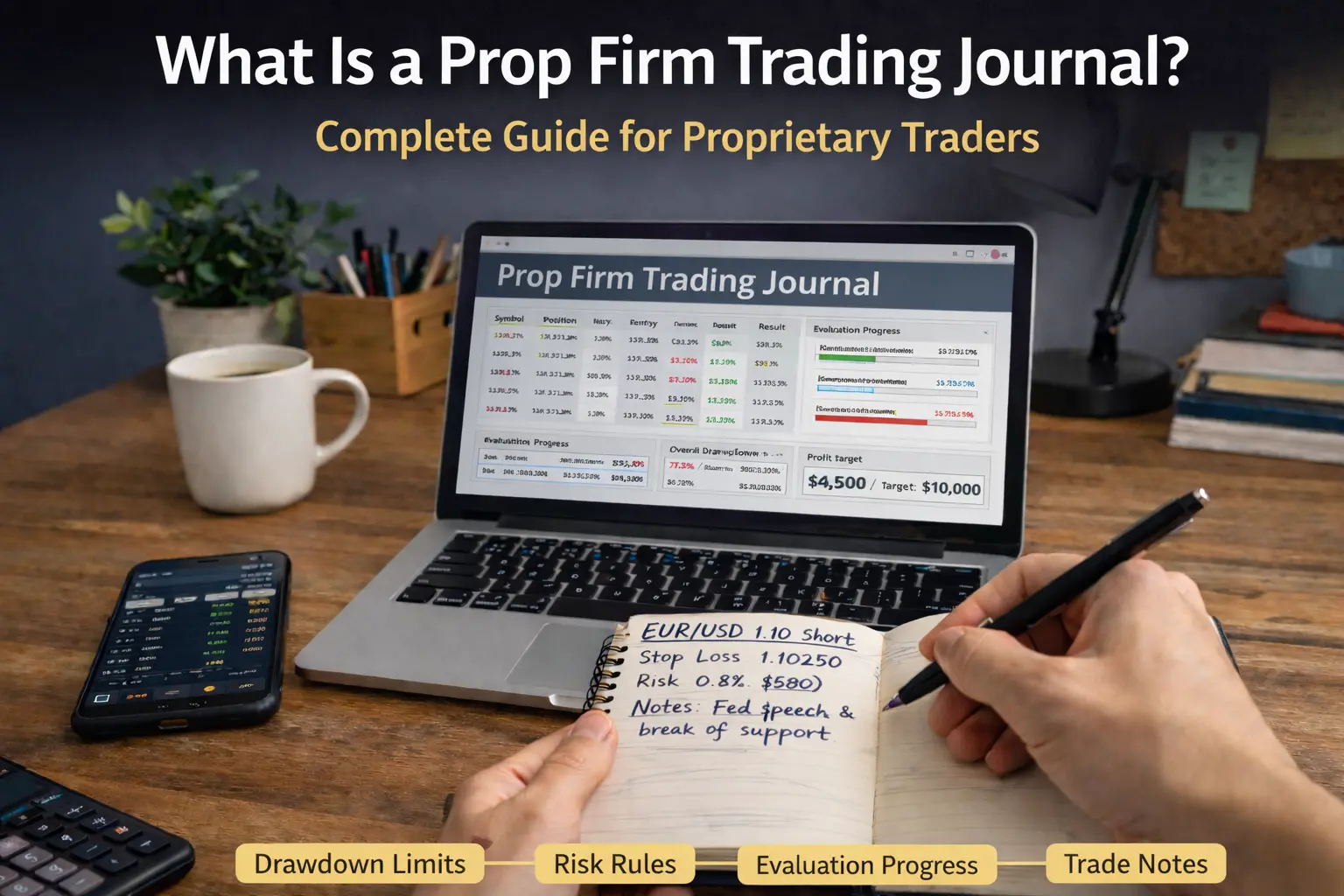

A crypto trading journal provides a systematic way to document, analyze, and refine trading decisions in the digital asset market. Without structured documentation, traders may rely on memory, which can distort past performance and decision quality. Over time, this lack of measurable analysis can result in repeated mistakes and inconsistent risk management.

This guide explains what a crypto trading journal is, how it works, its main features, and why it can support disciplined cryptocurrency trading.

What Is a Crypto Trading Journal?

A crypto trading journal is a structured record of cryptocurrency trades. It documents trade details and contextual reasoning to allow performance analysis over time.

Typical entries include:

- Cryptocurrency pair (e.g., BTC/USDT, ETH/USDT)

- Exchange used

- Entry and exit price

- Position size

- Leverage (if applicable)

- Stop-loss and take-profit levels

- Trade duration

- Strategy type

- Market conditions

- Profit or loss outcome

- Personal notes or psychological state

Traditionally, traders recorded this information manually in spreadsheets. However, many now use online crypto trading journal platforms designed to handle digital asset–specific data such as perpetual contracts, funding rates, and multiple exchange activity.

The purpose of a crypto trading journal is not simply to track profits. It is to evaluate consistency, risk management discipline, and strategy reliability in a highly volatile market.

How Does a Crypto Trading Journal Work?

A crypto trading journal generally operates through three primary processes: logging, categorization, and analysis.

1. Trade Logging

The first step is accurate documentation. Depending on the platform, traders may:

- Manually input trade data

- Upload CSV trade history from exchanges

- Sync with exchange APIs (if supported)

Logged details often include:

- Entry and exit prices

- Quantity or contract size

- Margin used

- Leverage ratio

- Fee cost

- Funding payments (for derivatives)

- Account equity at the time of trade

Accurate input is essential for reliable analysis.

2. Trade Categorization

Crypto markets consist of various trading styles. Journals often allow categorization by:

- Strategy (trend-following, breakout, scalping, range trading)

- Asset category (large-cap coins, altcoins, meme tokens)

- Market phase (bullish trend, consolidation, sharp correction)

- Trade type (spot, futures, perpetual, options)

Categorizing trades helps traders analyze whether certain strategies or coin types perform consistently under specific conditions.

3. Performance Analysis

After accumulating sufficient data, the journal calculates performance metrics such as:

- Win rate

- Average return per trade

- Risk-to-reward ratio

- Maximum drawdown

- Profit factor

- Equity curve trend

- Performance by coin

- Performance by leverage level

Given the high volatility in crypto markets, analysis can reveal whether profits are sustainable or largely driven by elevated risk exposure.

Key Features of a Crypto Trading Journal

A structured crypto trading journal typically includes:

Digital Asset Trade Logging

Fields designed for cryptocurrency pairs, derivatives contracts, and margin usage.

Leverage and Funding Tracking

Important for futures and perpetual swap traders.

Multi-Exchange Data Support

Many traders operate across exchanges; structured aggregation improves clarity.

Strategy Tagging

Allows segmentation by trading style.

Performance Dashboard

Provides overview charts and summary statistics.

Drawdown and Risk Analysis

Measures peak-to-trough equity declines and risk concentration.

Psychological Reflection Section

Helps document emotional decisions during volatile price swings.

These features transform raw exchange history into actionable trading insights.

Benefits of Using a Crypto Trading Journal

1. Improves Risk Discipline

Crypto markets can move rapidly. Structured journaling reinforces consistent risk limits and position sizing rules.

2. Reveals Over-Leverage Patterns

High leverage may temporarily increase returns but also magnifies losses. Tracking leverage over time promotes awareness.

3. Identifies Strategy Reliability

Certain strategies may perform well during bull markets but poorly during consolidation. Data segmentation highlights these patterns.

4. Reduces Emotional Trading

Crypto volatility can trigger impulsive decision-making. Recording trade rationale encourages deliberate execution.

5. Enhances Long-Term Consistency

Journaling introduces accountability and measurable review into an otherwise fast-paced environment.

Who Should Use a Crypto Trading Journal?

Spot Traders

Can evaluate coin selection and entry timing effectiveness.

Futures and Perpetual Traders

Benefit from detailed leverage and funding analysis.

Day Traders

Need structured evaluation of rapid trade sequences.

Swing Traders

Can review multi-day volatility positioning and macro narratives.

Active Portfolio Managers

May track allocation balance and asset exposure.

In short, any trader engaging in systematic crypto trading can benefit from structured journaling.

Crypto Trading Journal vs. Basic Spreadsheet

Spreadsheets allow manual tracking but may lack:

- Automatic fee inclusion

- Real-time performance summaries

- Leverage impact analysis

- Equity curve visualization

- Drawdown monitoring

- Multi-exchange consolidation

Dedicated crypto journaling platforms may reduce manual calculation errors and provide deeper analytics.

Common Mistakes Crypto Traders Make Without Journaling

Without structured documentation, traders often:

- Increase leverage after losses

- Trade impulsively during volatility spikes

- Ignore fee impact on profitability

- Fail to track funding payments

- Repeat underperforming coin selections

- Overexpose to correlated tokens

These behaviors can result in unstable performance over time.

How to Choose a Crypto Trading Journal

When selecting a crypto trading journal, consider:

Asset Support

Compatibility with spot, futures, and derivatives markets.

Fee and Funding Calculation

Accurate tracking of trading fees and funding payments.

Performance Breakdown

Ability to segment by coin, strategy, or timeframe.

Data Automation

Exchange import support reduces manual effort.

Security Standards

Crypto-related data requires secure storage practices.

Choosing the right platform depends on trading frequency and complexity.

Conclusion

A crypto trading journal is a structured performance analysis system designed for cryptocurrency markets. By recording trades, categorizing strategies, and analyzing measurable outcomes, traders can better understand risk patterns and behavioral tendencies.

In markets characterized by continuous trading and high volatility, systematic review becomes an essential component of long-term improvement. While journaling does not eliminate risk, it introduces discipline, transparency, and accountability into the trading process.

Reference Sources

To ensure factual accuracy and educational neutrality, this guide references digital asset market education and regulatory resources, including:

- U.S. Securities and Exchange Commission (SEC) — Digital asset investor education https://www.investor.gov/

- Commodity Futures Trading Commission (CFTC) — Virtual currency and derivatives guidance https://www.cftc.gov/

- Financial Action Task Force (FATF) — Global policy guidance on digital assets https://www.fatf-gafi.org/

- Educational materials on blockchain market structure and behavioral finance research.

This article is provided for educational purposes only and does not constitute financial advice.

Frequently Asked Questions (FAQs)

What is the primary purpose of a crypto trading journal?

To track and analyze cryptocurrency trading performance and risk management consistency.

Is a crypto trading journal only for professional traders?

No. Both beginners and experienced traders can benefit from structured performance review.

Can journaling reduce trading losses?

Journaling does not eliminate risk, but it can improve decision-making discipline and reduce repeated mistakes.

How often should crypto traders review their journal?

Many traders conduct weekly summaries and deeper monthly performance reviews.

Is manual journaling sufficient?

Manual methods can work, but structured platforms often offer deeper analytics and automation support.